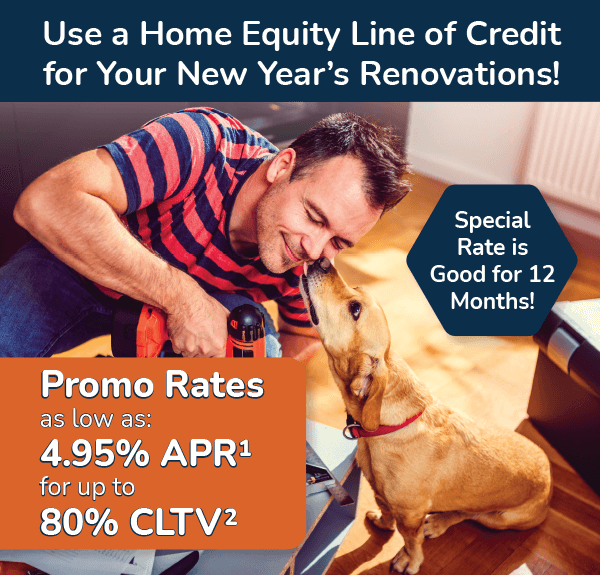

New Year, New Projects. Let Your Home Help You Get There!

Kick off the new year with a fresh start and a special 4.95% APR1 HELOC for up to 80% CLTV2 for 12 months, designed to help you tackle home improvements, consolidate debt, or fund what matters most.

A new year is the perfect time to finally take on those projects you’ve been dreaming about; the kitchen update, the bathroom refresh, or even knocking out high-interest debt.

With a Home Equity Line of Credit (HELOC) from Credit Union of Denver, you can tap into the value you’ve built in your home and use it on your terms.

For a limited time, enjoy:

- 4.95% APR1 for up to 80% CLTV2 for the first 12 months

- Flexible access to funds when you need them

- $0 Closing Costs, in most cases (an appraisal may be required at member’s expense)

- Only a 1% minimum repayment amount

Because we’re a credit union, our goal isn’t just lending; it’s helping our neighbors move forward with confidence.

Start the New Year Strong

Apply before March 31, 2026 and see how a HELOC can help you turn New Year plans into reality.

Get Started

To speak to a Credit Union of Denver Loan Specialist, give us a call 303.202.5659 | 800.280.0234 or email us at loans@cudenver.com.

HELOC

Current Best Rate: 6.25% VAPR1 80% CLTV2 (as of 03/01/2026)

A Home Equity Line of Credit (HELOC)1 is a form of revolving credit in which your home serves as collateral. You qualify for a certain amount and draw on it as you need and pay back the amount in payments like you would a credit card.

- $0 Annual Fee

- $0 Closing Costs, in most cases (an appraisal may be required at member’s expense)

- 80%-90% CLTV2 (Combined Loan to Value)

- Access funds via credit card or transfer into your checking account

- Ability to re-use funds as you pay down the balance

- 1% Repayment Terms

- 10 Year Draw Period and 10 Year Repayment Period (20 years total)

- Card Management tools

Get Started

To speak to a Credit Union of Denver Loan Specialist, give us a call 303.202.5659 | 800.280.0234 or email us at loans@cudenver.com.

Use this calculator to estimate your home equity line of credit payment

“Our C·U·D HELOC was perfect for updating the outside of my home. After spending so much time at home lately, I had time to design and update my 1970’s home. Now it reflects the craftsman style that I love and gravitate toward!”

Michele L. - member since 2014

HELOC FAQs

A Home Equity Line of Credit is a form of revolving credit, like a credit card, in which your home serves as collateral. And since your home is most likely your largest asset, why not put it to work for you and take advantage of all the benefits a Credit Union of Denver HELOC offers! Access to your money is easy and our Equity loans are flexible enough to fit your specific needs for home improvements, bill consolidation, college tuition, a family vacation or whatever you can dream up!

Much like a credit card that allows you to borrow against your spending limit as often as needed, a HELOC gives you the flexibility to borrow against your home’s equity.

For example, say you have a home worth $400,000 with a balance of $250,000 on your first mortgage and you want to access up to 80% of your home’s value (based on Combined Loan To Value – CLTV) stats. You can establish a HELOC with up to a $70,000 limit:

- Home Value at $400,000 x 80% = $320,000.

- 80% minus what you owe is $320,000 – $250,000 = $70,000.

- $70,000 would be the amount you could use, for this 80% CLTV example.

Use our Home Value Checker to see what your home may be worth.

A HELOC has two phases. First is the draw period, followed by the repayment period.

During the draw period, you can borrow from the credit line by card. The length of the draw period and the repayment period for Credit Union of Denver are 10 years each.

Payments on a HELOC are not much different than a credit card. Minimum monthly payments are required. The re-payment terms are at least a 1% payment on the outstanding balance. This is true for the entire 20 year term. During the repayment period, or last 10 years of the HELOC, you can no longer borrow against the credit line. Instead, you pay it back in monthly installments that include principal and interest. If you don’t pay off the total due in that last 10 years, it will end up having a balloon payment for the balance owed.

After you qualify for a certain amount, use your HELOC for things like: home improvements, education, debt consolidation, medical bills, or a much needed vacation. The choice is yours!

Simply use your issued Credit Union of Denver MasterCard® with your HELOC to access your equity funds.

For any tax implications, please consult your tax advisor.