Credit Union of Denver’s Mobile Deposit enables you to deposit checks to your account, using your Smartphone, from anywhere! Whether you’re stuck at home, in a snowstorm, or away on a business trip – you don’t need to waste time or gas driving to a branch or looking for the nearest ATM. Simply enroll in Mobile Deposit through our Mobile App and turn your home, office, or couch into a virtual C·U·D branch!

To be eligible for mobile deposit the members must meet these requirements:

- Account must be open for at least 30 days

- All account owners must be in good standing

- All account owners must not have caused a loss to C·U·D

The accounts restricted from using Mobile Deposit includes:

- Business Accounts, Trust Accounts, Estate Accounts, REP Payee, and TTM Accounts

- Members who have caused C·U·D a loss

- Members who have abused our Mobile Deposit service

- Members that are determined ineligible by C·U·D

Mobile Wallet – Payment by Smart Device

What is it?

Mobile Wallets are a way to carry your Credit Union of Denver Credit Card or Debit Card information in a digital form on your mobile device. Instead of using your physical plastic card to make purchases, you can pay with your Smartphone, tablet, or smartwatch. Stay contactless and pay merchants with your mobile device!

We offer our members Apple Pay®, Google Wallet™, and Samsung Pay®. Using the mobile wallet that corresponds with your mobile device, upload your C·U·D Credit Card or Debit Card into the app – then simply tap and Pay!

How to Add a Card to Your Mobile Wallet

You can easily add your issued and active card information to a mobile wallet directly from your digital banking app. Instead of manually entering card details, you can simply push the card information to the digital wallet with a tap!

Instructions

-

Launch the C·U·D Digital Banking App.

-

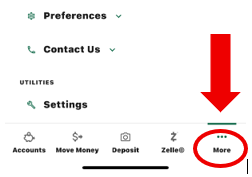

Select 'More' in the bottom right-hand corner.

-

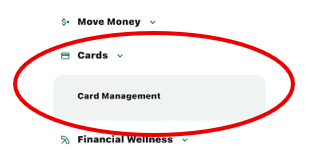

Select Cards and Card Management.

-

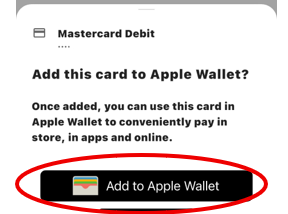

Select the card you want to add to Mobile Wallet. Scroll down to the bottom of the screen and select Add to Apple Pay (or Google Wallet).

-

Select Add to wallet. Apple Wallet is shown as an example.

-

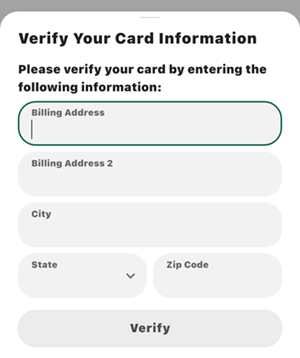

Enter billing address information.

-

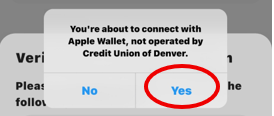

Select Yes.

-

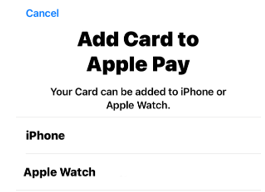

If you have multiple eligible devices, you will need to select which device you are adding the card to.

-

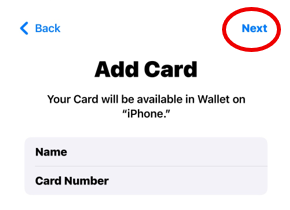

Select Next (this screen will be automatically filled in).

-

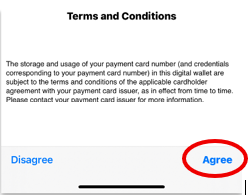

Agree to Terms and Conditions.

-

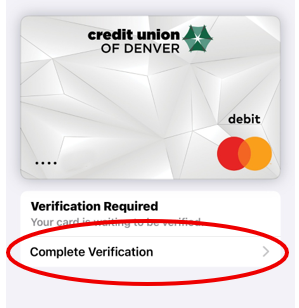

Select Complete Verification.

-

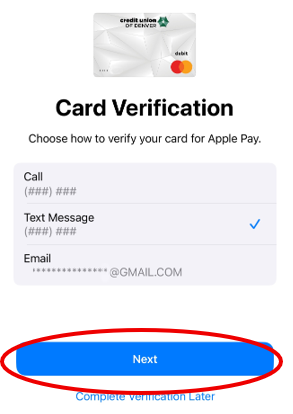

Select a verification method. Text message and Email will send a verification code. Call will direct you to our Card Holder Services.

-

After verification, the card will now display in your Digital Wallet! Please note, this may take up to 24 hours.

Here are a couple of tips to keep in mind when using your Mobile Wallet:

- Not all retailers will offer this type of payment option, so make sure to ask before you tap!

- Look for the symbols on or around the payment device or ask which ones they accept.

- Always run your charge as “Credit”, even if it is your debit card. This will assist with the tokenization and prevent you from having to use your PIN.