Available Exclusively within Digital Banking

Life happens. Whether you're planning a getaway, catching up on bills, or just need a little breathing room, our Skip-A-Pay program gives you a payment break when you need it. Relief when you decide - not just during the holidays.

✅ Eligible Loans Include*:

- Auto Loans

- Motorcycle & Recreational Vehicle Loans

- Personal Loans

- Membership Savings Secured Loans

💰 How It Works:

- Pay just $15 per skipped payment

- Skip one payment once every 6 months, per eligible loan

- Skipped payment is for one month

- Access easily through Digital Banking – via app or online

Don’t have Digital Banking? Get started below:

Digital Banking

Thinking of Skipping a Payment?

Skipping a payment gives you extra cash now, while keeping your loan in good standing. Finance charges still apply, and your loan term may be extended.

🎯 Ready to skip? Log in to your account within digital banking or contact us today with any questions.

FAQs

Skip-A-Pay can be found exclusively within Digital Banking; either via our app or by logging in via a browser.

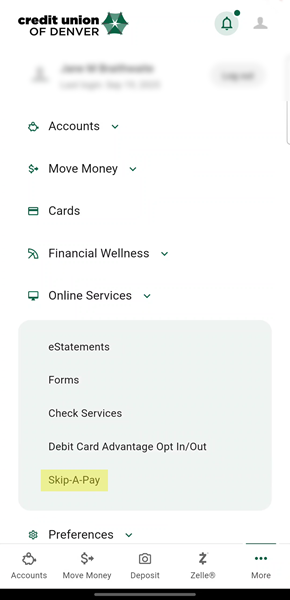

Skip-A-Pay can be found in the app by selecting:

- The ‘More’ section

- Then scrolling down and selecting ‘Online Services’

- And then selecting ‘Skip-A-Pay’

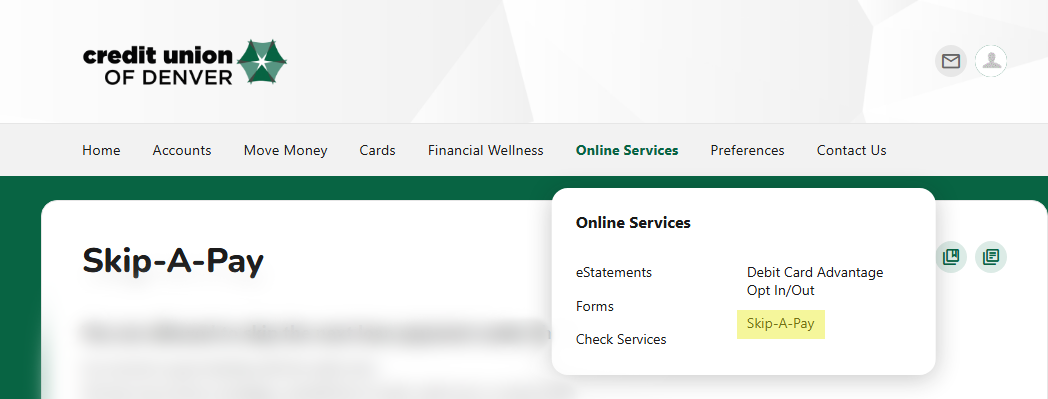

Skip-A-Pay can be found in the browser version of digital banking by selecting:

- The ‘Online Services’ section

- And then selecting ‘Skip-A-Pay’

Mortgage loans (Fixed Rate Loans & Home Equity Line of Credit ie. HELOCs), Credit Cards (Platinum & Secured MasterCards), Overdraft Lines of Credit, Certificate Secured Loans (CD Secured Loans), Open Lending Loans (Lenders Protection Loans), Workout Loans (Debt Modifications), and loans with Collateral Protection Insurance (CPI) added during life of the loan do NOT qualify.

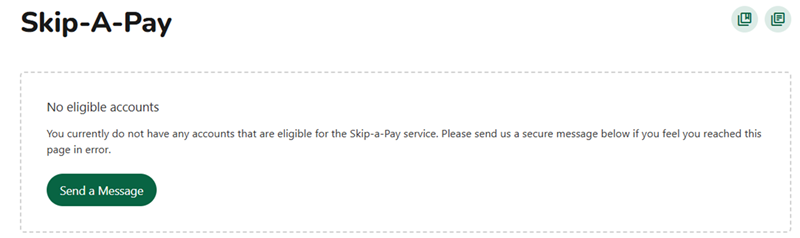

If you do NOT have an eligible loans, a message will display to inform you like the one below:

Yes, the following makes a loan eligible for Skip-A-Pay:

- At least six (6) months of regular loan payments have been made

- The loan has not been skipped during the previous six (6) months

- There is NO partial payment made to the loan

- The loan is NOT MORE than 29 days past due

- The loan is not paid ahead more than 30 days

- You also must be in good standing (not have caused a loss) to the credit union

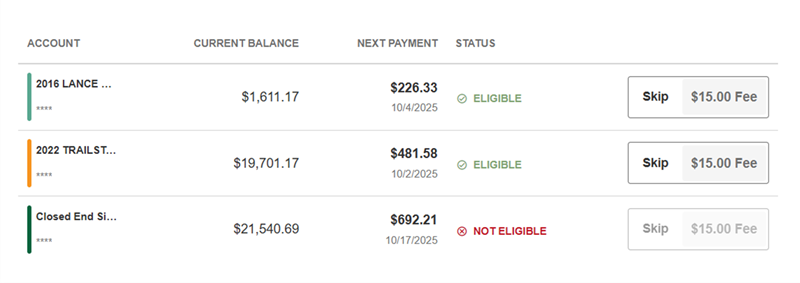

Each of your loans will be reviewed in order to see if they meet the criteria. You will be able to tell which loans are eligibile after selecting Skip-A-Pay in Digital Banking.

Example of Eligible and Ineligible Loans in Digital Banking:

You may only skip one (1) monthly payment per loan. The next payment due date must be no more than one (1) month in the future.

For weekly, bi-weekly, or semi-monthly payments, the loan will be advanced four (4) weeks.

You may skip one payment once every (6) months, with a maximum of twice per calendar year on a given loan, as long as it meets the criteria.

There is a $15 fee for each skip payment request.

Requests will usually be processed within 24 hours.

You are responsible for suspending any automatic payments that may occur on your loan(s) if your payment is being pulled from an external financial institution. Please contact us via secure Message Center for assistance.

The Message Center can be found in the app by selecting:

- The ‘More’ section

- Then scrolling down and selecting ‘Contact Us’

- And then selecting ‘Message Center’

The Message Center can be found on the browser version of digital banking by selecting:

- The ‘Contact Us’ section

- And then selecting ‘Message Center’

- To make the fee payment, funds must first be available in your C·U·D account.

- If there are no funds in the account, the system will not allow you to select a funding source or proceed with the fee payment.

- As alternative options:

- You may visit a branch to complete a cash advance into your account, or you may call our Contact Center to help you deposit funds into your Savings Account (please note, this option has a one-day processing time).

- You may transfer funds into your C·U·D account using an external account via ACH, using the 'Move Money' option in Digital Banking.

- You may also transfer funds from a Credit Card or Overdraft Line of Credit into your Savings or Checking Account to cover the fee.