Has your credit score recently taken a hit from using those credit cards over the holidays? Or maybe you don’t have a lot of credit and want to build up your credit score. It can be difficult to know where to start, here are ways to help improve your credit score.

What is a good credit score and why does it matter

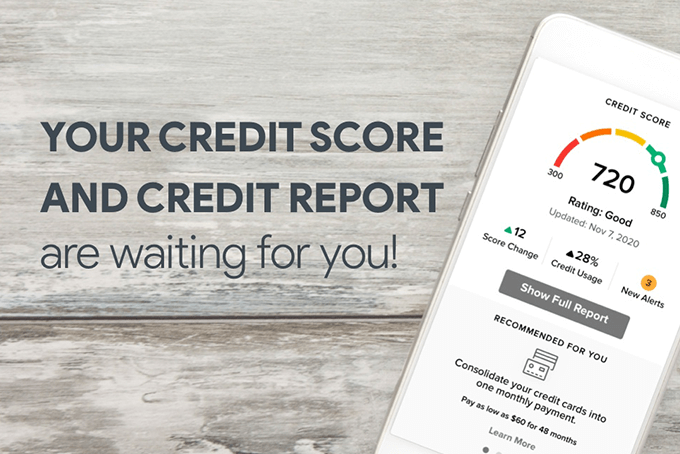

Generally speaking, 690 to 719 is a good credit score on the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. A score below 630 falls into the bad credit range. Your score is an indication of your creditworthiness. Which essentially, determines whether you can borrow money and how much you'll pay in interest to do so. Having a higher credit score can come with many potential benefits.

- You may have access to more lending options.

- You’re more likely to get approved.

- You may qualify for lower interest rates on credit cards.

- You may get approved for higher credit limits.

- You may have an easier time renting an apartment.

- You may get better car and homeowners insurance rates.

Where can you see your credit score

CUD members can check their credit score by accessing Credit Score and More, available in online or mobile banking. Credit Score & More is a comprehensive credit score program offered by Credit Union of Denver to help you stay on top of your credit. You get your latest credit score and report, and an understanding of key factors that impact the score. It can also monitor your credit report daily and can communicate to you if there are any big changes detected.

How long does it take to boost your credit score

Credit scores are determined by five different factors: payment history, credit utilization, credit history, credit mix, and new credit. How long it takes to repair bad credit depends on your individual circumstances. If an error on your credit report is dragging your scores down, you can dispute the error with the credit reporting agency. Unless the reporting agency considers your dispute frivolous, it must investigate, usually within 30 days. If bankruptcy or delinquent payments are the reason for lower scores, it might take a little longer to repair. But most things won’t impact your scores forever, and the effects of negative factors may lessen over time. Check out these tactics to assure a good score.

How to improve your credit score

How much your credit score will improve and how soon you’ll see improvement will depend on your unique credit situation. Not all situations are created equal, but the following steps can improve most credit scores.

- Your financial situation has improved.

If your debt-to-income ratio (your monthly debt payments divided by your gross monthly income) has improved, it’s likely your credit score has too.

Credit usage is calculated by dividing your credit card balance by the card’s credit limit. For example, if your credit card balance is $5,000 and your credit limit is $10,000, your credit usage is 50%. Most experts recommend keeping your credit usage below 30%, and below 10% to help you get a top credit score.

- Ask for a higher credit limit.

Give your credit card company a call and ask for a higher credit card limit. If they say yes, you’ll lower your credit usage percentage, which can raise your overall score. However, some companies may make a hard inquiry when looking at your credit report, which can knock a few points off your score temporarily, but you’ll likely make up for it over time with a higher credit limit.

This one is important, many factors make up your credit report, but your record of paying bills on time is the largest scoring factor in credit scoring models. Late payments can stay on your credit report for over seven years. Consider using a reminder app to set recurring reminders or use automatic payments to cover the minimum amount due.

- Catch up on past-due bills.

Life happens. If you find that you’re behind on bills, it’s important to do everything you can to catch up. Missed payments can pile up in your credit history and negatively impact your score for years. Staying on top of your bills is good for your credit score, even if you’ve missed payments in the past.

- Avoid too many hard inquiries.

Hard inquiries come into play when you apply for a new line of credit. You should limit how often you apply for new accounts.

- Correct mistakes on your credit report.

Keep an eye on your credit report. If something doesn’t seem right, you should dispute it. Errors on your credit report can bring your score down, so it’s important to give the major credit reporting bureaus a call (Experian, Equifax, and TransUnion) and make things right.

Having a diverse credit mix (the types of different credit accounts you have) is ideal for maintaining the best possible credit score. A diverse credit mix includes the two main types of credit: revolving and installment. Credit cards are an example of revolving credit. Mortgages, auto loans, and personal loans are examples of installment credit. If you only have one or the other, consider adding what you mix is missing to help balance things out.

- Don’t close accounts that are paid off.

Paid off a credit card? Excellent! It’s important to keep it open, even if you don’t plan on using it. This will help you maintain the length of your credit history. It will also help keep your credit usage percentage low, and your credit mix diverse.

No matter where you’re starting on the path to a healthier credit score, you deserve some credit (the acknowledgment kind). Start small, and let your own financial goals lead the way. You’ve got this.

Sources and enhanced by Credit Union of Denver