Ever wondered where the idea of a financial institution owned by its members came from? You're not alone! The story of credit unions is a fascinating journey that began with the simple idea of people helping people and grew into a powerful movement for financial empowerment across America.

Let's take a trip down memory lane and see how credit unions became America's financial cooperatives.

The credit union concept first crossed the Atlantic from Europe to Canada, where Alphonse Desjardins founded the first North American credit union in 1900 to combat predatory lending rates. Inspired by this success, the movement arrived in the United States in 1909 with the opening of our very first credit union in New Hampshire. A dynamic duo of a Boston merchant (Edward Filene) and an attorney (Roy F. Bergengren) then took the reins, working tirelessly to get laws passed that would let these member-owned cooperatives pop up all over the country.

Their efforts paid off in a big way during the Great Depression.

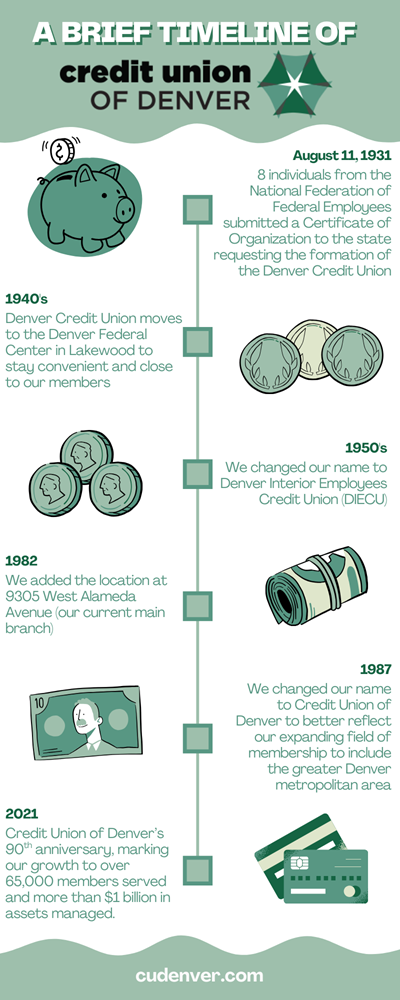

In 1934, as many banks were failing, President Franklin D. Roosevelt signed the Federal Credit Union Act into law. This pivotal act created a national system and gave credit unions an official stamp of approval, building trust and stability when people needed it most. Fun fact: Your very own Credit Union of Denver got its start a few years before that, becoming part of this growing movement in 1931.

As the financial world evolved, so did the need for strong oversight.

So, in 1970, Congress created the National Credit Union Administration (NCUA). Think of them as the friendly but firm referees who charter, supervise, and ensure federal credit unions, protecting your hard-earned money and making sure the system stays strong and ran with integrity.

Even during the Great Recession of 2007, credit unions proved their resilience.

The period saw closures and new governmental acts, yet the rock-solid cooperative model held strong, and credit unions were able to offer members more flexible loan options and stability when many traditional banks fell short.

Today, as we navigate the 2020s, technological advancements are reshaping everything.

Cybersecurity has become a top priority for the NCUA, with new rules and initiatives focused on keeping you and your money safe from digital threats. It's a critical new chapter for an old-school idea built on trust.

Even after all these years…

Credit unions remain stronger than ever! The journey from a small, pioneering association in New Hampshire to a national powerhouse is a true testament to the collaborative spirit of credit unions. As of the first quarter of 2025, this powerful movement supports over 143 million members and holds a collective net worth of a whopping $259.3 billion. And here at Credit Union of Denver, we're proud to be part of that legacy, contributing our own 65,000 members and $1 billion-plus in assets to that collective success.

At the end of the day, credit unions are still all about putting people first. They're member-owned organizations designed to listen to you and provide the best value possible. It's a tradition that's been going strong for over a century, and we're excited to keep it going for another 100 years and beyond!

For more information on our very own Credit Union of Denver, be sure to take a look at our timeline below or learn more here.